Overview:

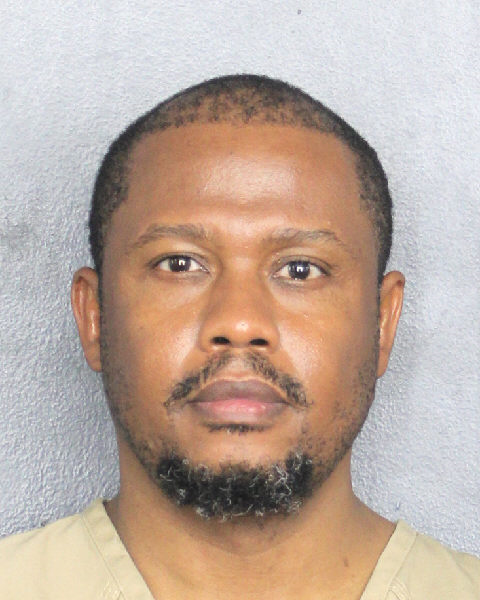

In courtroom information, investigators detailed how Marc Henry ”Marco” Menard ran a multi‑state buying and selling rip-off that lured Haitian traders by way of his firm, MarcoTech. The filings additionally define how Menard’s lack of response to summonses led to a $765,000 default judgment in a civil case. The felony case remains to be pending.

NEW YORK — For over a yr after being accused of economic fraud, Marc Henry ‘Marco” Menard failed to reply to allegations that he had swindled greater than 50 Haitian traders in three states out of at the very least $1.65 million, used the funds to bankroll an opulent life-style and made “Ponzi-like ‘curiosity’ funds” to traders.

But, regardless of sending summonses to Menard through e mail and publishing advisories in New York Metropolis information retailers, Menard, previously of Mineola, ignored them.

In the meantime, Laesha Jean-Louis, a girl described in courtroom information as Menard’s romantic associate, was dismissed as a co-defendant. By January 2025, the Securities & Change Fee (SEC) requested for a default judgment of their civil case towards Menard. A decide later granted the request, ordering Menard to pay $765,875.96 inside 30 days.

Nonetheless, no phrase from Menard in courtroom.

Then, on July 30, Detective Walter Lynch with the New York State Attorney General’s office referred to as police in Dawn, Fla. In accordance with the arrest report, native police went to the deal with within the 7600 block of Northwest twenty first Court docket, the place they met Lynch and took Menard into custody.

On Monday, Menard was lastly arraigned in Nassau County—the place his operation was primarily based—on 24 counts of grand larceny, violation of normal enterprise regulation, scheme to defraud and falsifying enterprise information. The case focuses on the alleged theft of $600,000 from 11 traders, some residing in Nassau, Suffolk, Rockland, and Queens Counties.

“Marc Henry Menard took benefit of Haitian New Yorkers, lied to them about his expertise as a profitable dealer, and swindled onerous‑working individuals out of lots of of hundreds of {dollars},” mentioned New York Lawyer Normal Letitia James within the information assertion asserting the arraignment.

“Menard handled himself to luxurious holidays and procuring journeys at his victims’ expense, and now we’re bringing him to justice,” James added. “Now we’re bringing him to justice.”

MarcoTech lengthy whispered suspect

Menard’s prosecution marks the newest in a collection of economic crimes totaling thousands and thousands involving the Haitian group in recent times. For some, Menard’s case highlights the painful actuality that some group members will succumb to the temptation of constructing fast cash, even when the dangers are excessive and previous funding scams and penalties are well-documented. It acknowledges, nonetheless, that the self–proclaimed securities merchants could not intend to defraud individuals, however can get in over their heads.

Sure group members have suspected Menard of fraudulent actions. His identify got here up commonly because the EminiFX cryptocurrency fraud case made its approach by way of the courts in 2022 and 2023. Some individuals instructed The Haitian Occasions or commented through the web site that that they had invested with MarcoTech and NovaTechFX.

In all three instances, investigators describe hallmarks of such affinity frauds, the place the accused ringleader depends on their group’s belief to perpetuate the monetary crimes.

Loojimps Marcius, an authorized monetary planner (CFP) and enterprise coach primarily based in Atlanta, referred to as such instances of fraud “painful” for the Haitian group. He repeated one enduring piece of recommendation echoed throughout monetary areas and communities.

“If it sounds too good to be true, it’s doubtless not true,” he mentioned. “While you begin seeing a sure stage of returns or which are normally assured, that’s normally a purple flag.”

Buying and selling up on fraudulent funds

Menard, particularly, is accused of working a fraudulent buying and selling scheme between July 2020 and September 2023 by way of his firm, MarcoTech LLC, in line with the default judgment. Prosecutors mentioned he used his standing throughout the Haitian-American group to lure mates and different group members into investing at the very least $1.65 million with him.

Claiming that he had been investing since 2020, Menard allegedly promised traders returns of 12% to twenty% per thirty days from buying and selling in shares and choices.

Throughout one assembly in Uniondale, N.Y., in July 2021, for instance, he instructed potential traders that he was within the prime 1% of merchants within the nation.

In September 2021, with one other potential investor, he claimed to be a millionaire because of his investments—and that particular person gave him $10,000 to commerce shortly after.

Investigators mentioned these claims have been all misleading. In actuality, Menard was not registered to promote securities and he misplaced $696,197 on his trades, prosecutors mentioned within the default judgment. He misappropriated the traders’ funds for private buying and selling and bills. Amongst purchases that traders’ cash allegedly lined have been a 2021 Mercedes‑Benz and a 2022 BMW, designer garments on the likes of Louis Vuitton and Gucci, presents, hire, the fitness center, the lottery, pet grooming companies and journeys to Turkey, Puerto Rico and Disney World.

To persuade traders the scheme was respectable, Menard confirmed them inflated account balances, buying and selling exercise screenshots and different misleading paperwork. He additionally made funds to prior traders in a Ponzi-like method.

In a single occasion, round August 2022, Menard despatched traders a screenshot of an ATM receipt exhibiting an account stability of $8 million. He wrote within the message: ‘$3M [is] for individuals I invested for. And the remaining is mine.’ When traders checked Menard’s accounts for that interval, they noticed that the mixed balances by no means exceeded $265,000.

Temptation and digitalization create new actuality

Menard’s seize and prosecution echo current instances involving members of the Haitian group as targets who have been duped by somebody they trusted, per prosecutors. Or—as some interviewers and courtroom paperwork have acknowledged—some are prepared individuals who take the danger to get wealthy rapidly.

In any such fraud, scammers goal members of their very own communities

Each are eventualities that monetary literacy and wealth-building professionals see too usually. Between the appearance of cryptocurrency and the ubiquity of digital buying and selling platforms, fraudulent schemes have turn out to be extra rampant throughout all generations, courses and ethnicities.

“There’s at all times this need for our inhabitants to get greater returns, virtually as a strategy to meet up with both not having a lot cash or not doing nicely,” mentioned Marcius, owner of Level X enterprise teaching and consulting.

“Though they generally assume it could possibly be [fraud], they leap in hoping they’ll get out in time,” he mentioned. “Sadly, more often than not, they’re closed down a lot sooner.”

Menard, a U.S. citizen, was launched below journey restrictions and surrendered his passport after Monday arraignment. Data for an legal professional for him was not instantly obtainable.

Editors Notice: Authorities urge anybody who could have been a sufferer of any such rip-off to report it to the Workplace of the Lawyer Normal by submitting a complaint online or calling 1-800-771-7755. Your identification will likely be protected in line with the suitable regulation and insurance policies.